In the sprawling world of Indian online shopping, Myntra sits in a spot hardly anyone would’ve bet on back in 2007. Think about it — today it’s got over 70 million monthly active users, more than 6,000 brands, and it’s no longer just about clothes; beauty, ethnic wear, lifestyle… You name it, they’re in. It’s practically a household name now.

This Myntra success story you’re about to read isn’t just a dry timeline. It’s about the grit behind the glitz: how a quirky little gifting portal morphed into India’s go-to fashion destination. We’ll walk through the early experiments, the big pivot, the smart (and sometimes risky) strategies, the bumps that almost tripped them up, and finally the takeaways anyone running a business or studying entrepreneurship can pocket for themselves.

Table of Contents

The Foundation of Myntra’s Success Story – Humble Beginnings & The Pivot

The Inception (2007): Founders & Early Vision

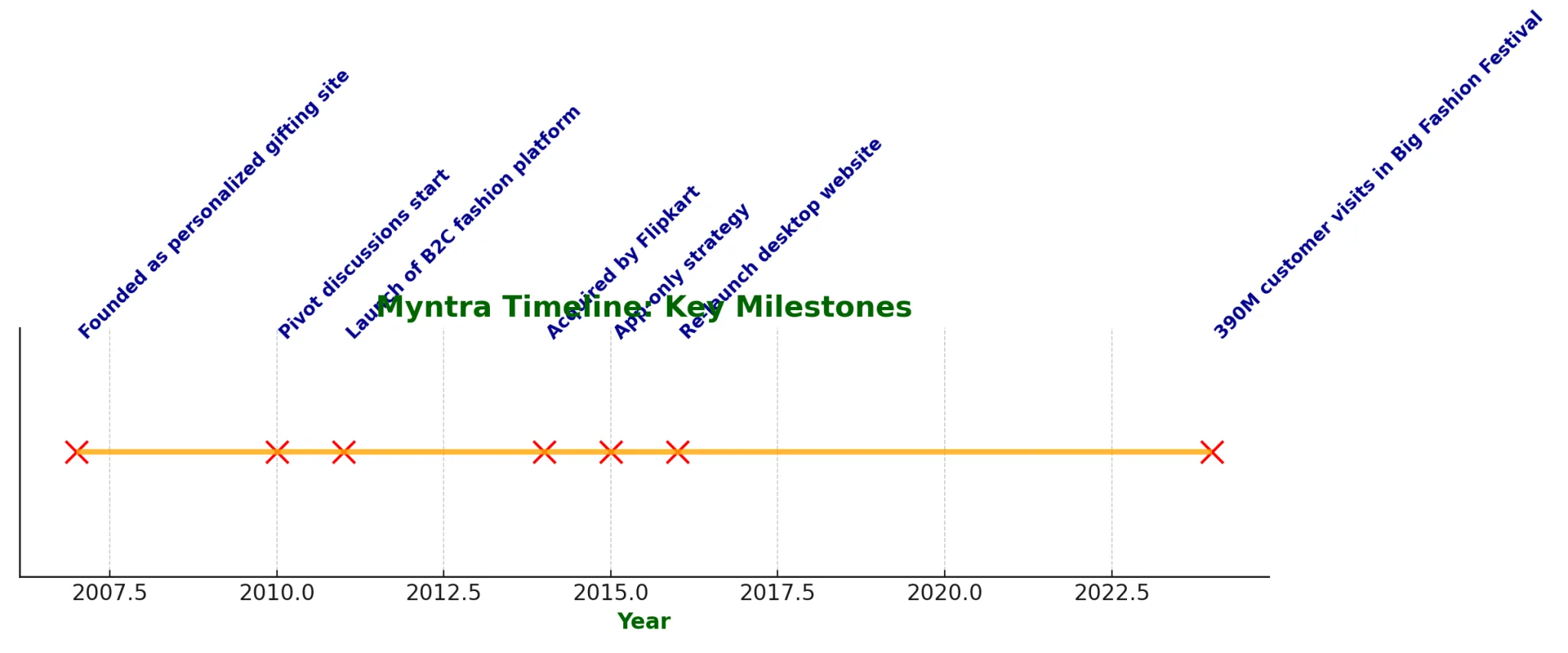

Rewind to 2007. E-commerce in India was still a toddler. Flipkart was just getting off the ground, and Amazon hadn’t even set up shop here. And in a small Bengaluru office, three founders — Mukesh Bansal, Ashutosh Lawania, and Vineet Saxena (some stories also credit Sankar Bora as an early co-founder) — were tinkering with a different idea altogether.

Back then, Myntra wasn’t selling trendy sneakers or designer kurtas. Nope. It started life as a personalised gifting site. Think mugs, T-shirts, calendars with your photo on them — the kind of stuff HR teams order for employee events or friends buy for birthdays. It was a scrappy, almost experimental model that spotted a little gap in the online market: people wanted quick, customisable gifts but didn’t have an easy way to order them.

It felt fresh and clever for the time, but as the founders soon realised, it wasn’t exactly a gold mine. Customers came once, maybe twice, then vanished. Logistics were fiddly. Acquisition costs were high. In other words, a neat idea but not one that could scale to the stars. And that realisation set the stage for one of the boldest pivots in India’s e-commerce history. At its origin, Myntra was not a fashion retailer but a personalised gifting platform: customised items such as t-shirts, mugs, mouse pads, and calendars.

The idea tapped into a gap: everyday gifting, corporate gifting, and customised branding were underserved and under-digitised. There was novelty, but also challenges: low repeat demand (you don’t constantly buy customised mugs), high logistics overhead, and low predictability. This constrained growth severely. The early team recognised these limits within a few years.

The Crucial Pivot to Fashion (2010-2011) – Myntra Success Story

By about 2010, Myntra’s leadership started seeing clear signals: fashion and lifestyle in India were opening up fast. Internet penetration was rising, mobile usage was increasing, branded fashion was still under-penetrated, and consumer behaviour was evolving.

The personalised gifting model simply did not scale the way fashion could. Mukesh Bansal has recounted a particular moment of insight, walking through a mall, noticing many empty stores during weekdays despite fashion being everywhere. There was untapped demand.

So around 2010-2011, Myntra pivoted its business model from B2B gifting towards a B2C fashion e-commerce and lifestyle platform. This meant sourcing brands, offering a broader range of products, managing fashion inventories, and building brand relationships. This pivot was risky—but necessary. It set the stage for all subsequent growth.

Lesson here: being alert to market signals (low repeat, high acquisition costs, burgeoning demand elsewhere) and having the courage to shift strategy.

The Growth Engine – Key Strategies for Myntra Success

In the pivot’s aftermath, Myntra didn’t just hope demand would carry them—they worked with a suite of strategies, many of them innovative, many of them risky. These were the levers that propelled Myntra into the top tier of Indian fashion e-commerce.

Building a Curated Brand Portfolio

From the early days, Myntra differentiated itself by onboarding branded fashion labels rather than generic apparel. Big international names like Nike, Adidas, and domestic players, too. This helped in building trust: customers associate branded labels with quality and status. Over time, Myntra expanded to mid-tier and value-for-money brands, giving coverage across price segments.

They also developed private labels: HRX (co-founded by Hrithik Roshan), Roadster, Dressberry, etc. These have been crucial for margin improvement—private labels can be priced more aggressively, and returns/wear-rates can be optimised. Private label strategy also helps in offering exclusivity. (Though note: private label execution has its own challenges—quality control, design, inventory risk.)

Turning Sales into Cultural Events: Big Fashion Days & EORS

Myntra didn’t treat large sales merely as periodic promotions. They made them into events: big fashion festivals, End of Reason Sale (EORS), Big Fashion Festival (BFF). These aren’t just discount windows but marketing spectacles: heavy promotion, celebrity tie-ups, flash deals, exclusive launches.

For example, during the Big Fashion Festival, Myntra saw ~390 million customer visits in 2024, over 1.5 million new customers added, and over 80% of those new customers came from non-metros. As per this report, Myntra’s net profit has jumped 18-fold for the financial year that ended in March 2025.

Also, during festive sales, MAU (monthly active users) touched ~70 million.

These large events became a tool not just for revenue, but for customer acquisition, creating buzz, and bringing in newer geographic regions.

Celebrity endorsements played a role too—Virat Kohli, Shah Rukh Khan, etc., helped create trust, aspirational appeal. Though the use and impact of celebrity marketing have to be balanced against costs.

Technology and User Experience (UX) – Myntra Success Story

Here, the Myntra success story is mixed but very instructive.

The App-Only Gamble (2015)

In 2015, Myntra made a bold move: shut down its desktop website (and mobile web) to become app-only from May 15. The rationale: apps allow better personalisation, better engagement (push notifications, camera integration), and better ability to build a one-to-one relationship with consumers.

However, the move backfired in several ways. Many users did not want to download an app; some preferred browsing or buying on a desktop. The user base felt restricted; shopping from a desktop was easier for browsing and comparisons. Sales growth slowed, and the company realised it had lost some ground. Recognising this, Myntra relaunched the desktop website (via web channels) in June 2016.

Learning: customer convenience matters over visionary ideology. A channel that seems secondary may still be essential.

Visuals, Fit, & Personalisation

Although specific features like AR or virtual fitting rooms have been experimented with (fitting tools, user-generated photos, etc.), one of the biggest strengths of Myntra has been its focus on visual richness, good photography, zoom-ins, and consistent brand representation. Also features such as Mosaic (AI/ML-driven personalisation) for recommending what to show each user, notifications based on browsing/past purchases, and curated homepages.

While we couldn’t find specific public data on AR-fitting from sources used here, the trend is clear in their “new features like MyFashionGPT, Maya, AI Stylist”, helping product discovery and personalisation.

Building a Robust Supply Chain & Logistics

A strong promise in e-commerce is “what you see is what you get, and you get it on time.” Myntra invested in warehousing, in reliable last-mile delivery (leveraging Flipkart’s logistics post-acquisition), and stands out in having return and exchange policies that are relatively user-friendly. Ease of returns builds trust in fashion, where fit/sizing issues are frequent.

Navigating Challenges ‒ The Bumps on the Road

No success story is without its challenges. Myntra’s trajectory has lessons in what to do and what to react to.

The Flipkart Acquisition (2014)

By 2014, the Indian e-commerce battleground was on fire. Amazon had just started throwing its weight around, Snapdeal was still a name to reckon with, and everyone seemed to be fighting for the same wallet. In May that year, Flipkart swooped in and bought Myntra in what newspapers kept calling a “landmark” deal—roughly USD 300 million (about ₹2,000 crore).

Even after the buyout, Myntra didn’t become just another Flipkart department. It kept its own brand voice, its own team vibe, but now had a bigger safety net—stronger logistics, a fatter marketing budget, and the ability to scale faster without gasping for breath.

Competitive Landscape

Fast-forward a bit, and the stage gets even more crowded. Ajio, Amazon Fashion, Nykaa Fashion—everyone’s chasing the same stylish young shoppers. To hold its edge, Myntra doubled down on what it already did best: curating, segmenting, and making the UX feel like a fashion magazine rather than a boring catalogue. It also jumped into beauty and lifestyle, so fashion wouldn’t become a narrow lane. But yeah, the competition brought headaches too—margin squeezes, tricky logistics, inventory risk, all that unglamorous stuff.

The “App-Only” Reversal

Remember that bold “app-only” move in 2015? Myntra shut its desktop and mobile site, thinking India was ready to live entirely on apps. Turns out, not quite. By mid-2016, after a noticeable sales slowdown and a fair bit of user grumbling, it re-launched the desktop site.

Lesson? Even when the tech trend (mobile, personalisation, push notifications) looks irresistible, you can’t yank away customer habits overnight. Innovation’s cool, but inclusivity of channels still matters.

Recent Innovations and Future Roadmap

Expansion into New Verticals

Myntra Beauty: Beauty and personal care have become a rocket ship. Over 1,500 brands and about 90,000 SKUs now sit in the beauty aisle, with 3–4× growth in the segment.

Ethnic Wear Premium Segment: Indian shoppers want quality ethnic wear for weddings and festivals, and Myntra’s been adding premium brands and styles like crazy.

Content & Studio Initiatives

Myntra Studio, style guides, live fashion shows, influencer collabs—the company’s trying to be more than a storefront. It’s like they’re saying, “Stick around, don’t just shop.” You see this in things like Myntra Rising Stars and shoppable content.

Focus on Tier-2 / Tier-3 Cities & Non-Metro Markets

This is where the real action is now. In big sale events, 45–80% of new customers come from small towns. International brands are quietly gaining traction in these markets too.

Social & Live Commerce

Live-stream shopping, influencer-led launches, curated drops with fashion creators—Myntra’s testing all of it. The goal? Mix entertainment with shopping and get people to click “buy” faster.

Tech Innovation & Efficiency

On the tech side, Myntra’s AI/ML personalisation tools are getting sharper. Its “Mosaic” platform builds personalised homepages, and there’s an AI stylist now. They’re also tinkering with rapid delivery pilots in metros.

Key Takeaways for Entrepreneurs and Business Students

The Power of the Pivot

The jump from a gifting portal to a fashion giant wasn’t some small tweak. It was gutsy, and it unlocked a far bigger opportunity.

Customer-Centricity Is Non-Negotiable

Easy returns, dual channels (app + web), high-quality visuals—these are deliberate decisions. You either reduce friction or watch people bounce.

Brand Over Discounts (But Sales Still Rock)

Credibility of the brands you carry is a long-term asset. But events like EORS and Big Fashion Festival aren’t just clearance sales—they’re magnets for new customers.

Technology as a Multiplier, Not a Substitute

Cool AI features are great, but they’re pointless unless they deliver ease, speed, and reliability. Customers smell gimmicks.

Experience & Events Create Loyalty

When a sale window feels like a festival—with celebrity tie-ups, anticipation, exclusivity—you’re building a memory, not just a transaction.

Don’t Underestimate Geography

India isn’t one big metro. Payment preferences, trust levels, and device types—they all shift outside big cities. You can’t copy-paste your metro playbook.

Risk, Experimentation & Reversion

The app-only fiasco proves experiments can flop. That’s fine. What matters is how fast you listen and pivot back.

Conclusion

From a modest gift-customisation startup in Bengaluru in 2007 to a tech-powered fashion powerhouse today, Myntra success story is all about adaptability and execution. It didn’t just make online fashion shopping mainstream. It made it accessible, visual, and even a bit fun—especially for shoppers beyond the metros.

Looking ahead, margins are going to stay tight, competition will get fiercer, and tech will keep evolving—think AR try-ons, voice commerce, live shopping. But Myntra’s track record of sensing change, doubling down on what clicks, and course-correcting when needed is encouraging.

If you’re building something of your own, Myntra’s story whispers a few truths: listen hard, iterate boldly, aim for excellence, and don’t be scared of the tough pivots.

More Success Stories:

FAQs About Myntra Success Story

Who founded Myntra and when?

Myntra was founded in 2007 by Mukesh Bansal, Ashutosh Lawania, and Vineet Saxena. Some accounts also mention Sankar Bora as an early co-founder. It began as a personalised gifting portal before pivoting to fashion e-commerce.

What was Myntra’s original business model?

Initially, Myntra focused on personalised gifts like mugs, T-shirts, mouse pads, and calendars. The aim was to serve both corporate and individual customers, but the model had low repeat demand and high logistics costs.

When did Myntra pivot to fashion e-commerce?

Around 2010–2011, Myntra shifted from B2B gifting to B2C fashion and lifestyle e-commerce. This pivot focused on branded apparel, footwear, accessories, and lifestyle products.

What are Myntra’s biggest growth strategies?

Key strategies include building a curated brand portfolio, launching private labels like HRX and Roadster, hosting massive sale events like EORS and Big Fashion Festival, investing in technology and personalisation, and ensuring robust logistics and easy returns.

What was the “app-only” strategy, and why did it fail?

In 2015, Myntra shut its website to go app-only, aiming to boost engagement and personalisation. It backfired as many users preferred desktop browsing. Myntra relaunched the website in 2016. Lesson: Customer convenience should come first.

When did Flipkart acquire Myntra?

Flipkart acquired Myntra in May 2014 for roughly USD 300 million (around ₹2,000 crore). Post-acquisition, Myntra retained its brand identity while benefiting from Flipkart’s logistics, marketing, and scale.

What verticals has Myntra expanded into?

Besides fashion, Myntra now offers beauty, lifestyle, and premium ethnic wear. It has initiatives like Myntra Studio, live fashion shows, influencer collaborations, and AI-driven personalisation tools like Mosaic.

How is Myntra reaching Tier-2 and Tier-3 cities?

During large sales events, 45–80% of new customers come from non-metro markets. Myntra leverages localised marketing, faster delivery, and curated selections to attract shoppers beyond big cities.

What lessons can entrepreneurs learn from Myntra’s journey?

Key takeaways include the power of pivoting, prioritising customer experience, leveraging brand credibility, using technology as an enabler, experimenting with new strategies, and staying adaptable to market changes.

What is Myntra’s current monthly active user base?

Myntra currently has over 70 million monthly active users and continues to grow, especially in non-metro regions.

NextWhatBusiness Research Desk represents the editorial research function at NextWhatBusiness.

Content published under the desk is based on independent research, operator-level observations, and analysis of small, medium, and franchise-led business models in India.

The focus is on practical decision-making — including capital requirements, operational effort, and risk factors — rather than promotional or brochure-driven information.

Some articles reflect editorial judgment based on observed patterns and may include opinionated analysis where appropriate.

Editorial oversight is provided by Rupak Chakrabarty, Editor, NextWhatBusiness.