Goods and Services Tax (GST) has revolutionized the Indian tax system. It has streamlined various indirect taxes into a single unified tax. For businesses, registering for GST is mandatory to comply with the law and enjoy the benefits of seamless tax credits. In this detailed guide, our tax experts will walk you through the online GST registration process, the necessary documents, and important aspects like cancelling, changing address, and surrendering GST registration.

Table of Contents

What is GST – Full Form and Definition

The full form of GST IS Goods and Services Tax. It is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. This single tax system takes the place of several indirect taxes that were previously imposed by India’s central and state governments. With its introduction on July 1, 2017, the GST seeks to reduce the cascading effect of taxes, streamline the tax code, and establish a single national market.

Key Features of GST

- Comprehensive Tax Structure: GST integrates various indirect taxes like Central Excise Duty, Service Tax, VAT, and others into a single tax.

- Multi-Stage Taxation: GST is levied at every stage of the production process but is ultimately borne by the end consumer.

- Destination-Based Tax: GST is collected at the point of consumption rather than the point of origin. This means the tax revenue goes to the state where the goods or services are consumed.

- Dual GST Model: India follows a dual GST model, where both the central government (Central GST or CGST) and the state governments (State GST or SGST) levy taxes on the same transaction.

- Input Tax Credit: Businesses can claim credit for the tax paid on inputs, which helps reduce the overall tax burden and prevents the cascading effect of taxes.

Benefits of GST

- Simplified Tax System: GST replaces multiple indirect taxes with a single tax, making compliance easier for businesses.

- Reduction in Cascading Effect: By allowing input tax credits, GST eliminates the tax-on-tax scenario, reducing the overall tax burden.

- Increased Compliance: The introduction of GST has led to better compliance due to its transparent nature and robust IT infrastructure.

- Boost to the Economy: GST aims to create a unified national market, encouraging trade and commerce across state borders.

- Higher Revenue Collection: The transparent and streamlined nature of GST has led to increased tax collections for the government.

How GST Works

Components of GST

- CGST (Central GST): Collected by the central government on intra-state sales.

- SGST (State GST): Collected by the state government on intra-state sales.

- IGST (Integrated GST): Collected by the central government on inter-state sales and imports.

Example of GST Calculation

Consider a manufacturer who sells goods worth ₹1,000 to a wholesaler. The GST rate is 18% (9% CGST + 9% SGST).

- Manufacturer to Wholesaler: The manufacturer adds ₹180 (18% of ₹1,000) as GST, so the total bill is ₹1,180. Here the CGST is ₹90 and SGST is ₹90

The wholesaler then sells the goods to a retailer for ₹1,500.

- Wholesaler to Retailer: The wholesaler adds ₹270 (18% of ₹1,500) as GST, so the total bill is ₹1,770. Here the CGST is ₹135 and SGST is ₹135

However, the wholesaler can claim an input tax credit of ₹180 (₹90 CGST + ₹90 SGST) already paid to the manufacturer, effectively paying only ₹90 (₹45 CGST + ₹45 SGST) as GST.

Finally, the retailer sells the goods to the end consumer for ₹2,000.

- Retailer to Consumer: The retailer adds ₹360 (18% of ₹2,000) as GST, so the total bill is ₹2,360. Here the CGST is ₹180 and SGST is ₹180

The retailer claims an input tax credit of ₹270 (₹135 CGST + ₹135 SGST) already paid to the wholesaler, effectively paying only ₹90 (₹45 CGST + ₹45 SGST) as GST.

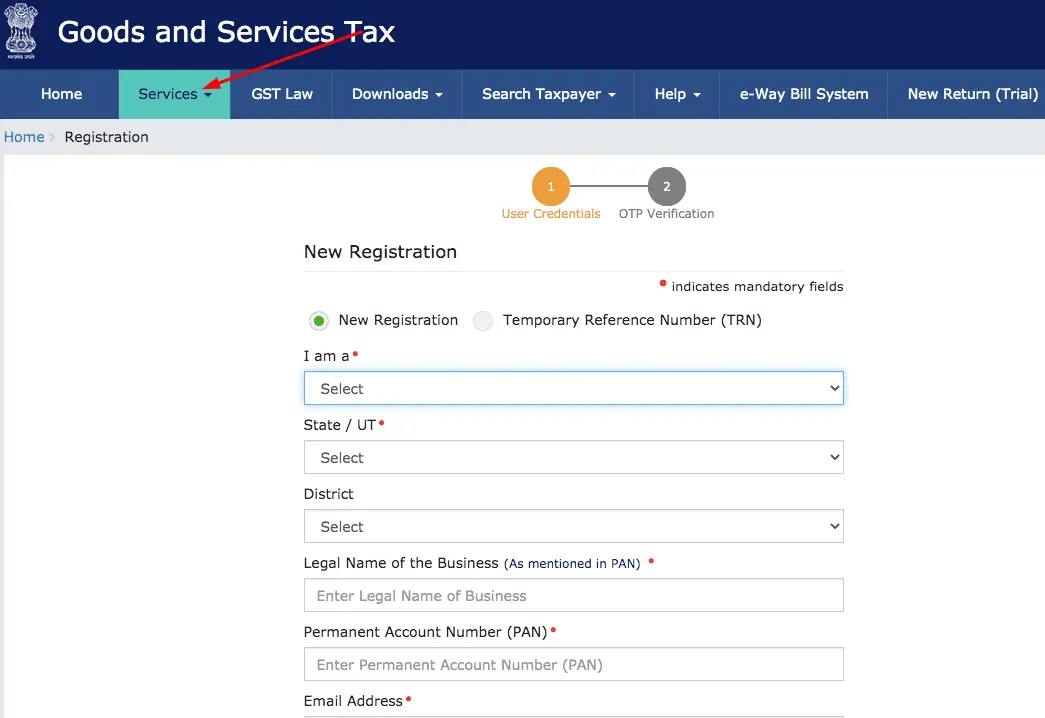

Application Process for Online GST Registration

Here are the 6 steps for GST registration in India:

- Visit the GST Portal: Go to the official GST portal at gst.gov.in and click on ‘Services’ > ‘Registration’ > ‘New Registration’.

2. Fill in the Details: Enter your PAN, email address, and mobile number. You’ll receive an OTP on your mobile and email for verification.

3. Generate TRN: Once verified, you’ll get a Temporary Reference Number (TRN) which you’ll use to complete the registration process.

4. Continue Registration: Log in with your TRN and complete the form with necessary details like business name, address, and bank account information.

5. Upload Documents: Upload scanned copies of required documents such as proof of business address, identity proof, and bank details.

6. Verification: The application is then verified by a GST officer. If all details are correct, you’ll receive your GSTIN (Goods and Services Tax Identification Number) within a few days.

Documents Required for Online GST Registration

- PAN Card: The PAN of the business or the applicant.

- Proof of Business Registration or Incorporation Certificate: This can be a partnership deed, incorporation certificate, etc.

- Identity and Address Proof: Aadhaar card, passport, driving license, or voter ID of the promoters or directors.

- Business Address Proof: Rent agreement, electricity bill, or property tax receipt.

- Bank Account Proof: A copy of the cancelled cheque, bank statement, or passbook.

- Photographs: Passport-size photos of the applicant (promoter/partners/directors).

How to Cancel GST Registration Online

Cancelling your GST registration might be necessary if you close your business or if the turnover is below the threshold limit.

Steps to Cancel GST Registration:

- Login to GST Portal: Use your credentials to log in.

- Navigate to Services: Go to ‘Services’ > ‘Registration’ > ‘Application for Cancellation of Registration’.

- Fill out the Form: Fill out the necessary details and provide the reason for cancellation.

- Verification: Submit the application. A GST officer will verify your request and, if everything is in order, will approve the cancellation.

How to Change Address in GST Registration Online

Changing your business address in the GST portal is straightforward.

Steps to Change Address

- Login to GST Portal: Enter your username and password.

- Navigate to Services: Go to ‘Services’ > ‘Registration’ > ‘Amendment of Registration Non-Core Fields’.

- Select Business Address: Choose the option to change the principal place of business or additional place of business.

- Update Address: Enter the new address and upload the required proof of address documents.

- Verification: Submit the application. It will be verified by a GST officer before approval.

GST Registration Online Fees

One of the advantages of GST registration is that it is free of cost on the government portal. However, if you choose to go through a third-party service or a consultant, they might charge a fee for their services.

How to Surrender GST Registration Online

If you wish to close your GST registration permanently, you can surrender it online.

Steps to Surrender GST Registration

- Login to GST Portal: Use your GST credentials.

- Navigate to Services: Go to ‘Services’ > ‘Registration’ > ‘Application for Cancellation of Registration’.

- Provide Reason: Enter the reason for cancellation and the details required.

- Verification: Submit the form. The GST officer will review and approve the application if all is in order.

Related Articles:

- How to Apply for Udyog Aadhaar MSME Registration

- Top GST Software in India

- How to Register a Private Limited Company in India

Frequently Asked Questions on GST Registration in India

Who needs to register for GST?

Businesses with a turnover exceeding the threshold limit of ₹20 lakhs (₹10 lakhs for special category states) need to register for GST. Additionally, certain businesses like e-commerce operators and inter-state suppliers are required to register regardless of turnover.

What is the penalty for not registering under GST?

Failure to register for GST can attract a penalty of 10% of the tax amount due or a minimum of ₹10,000.

How long does it take to get a GSTIN?

It typically takes about 3-7 working days to get a GSTIN if all documents and details are correctly provided.

Can I edit my GST registration details?

Yes, non-core details like business address, contact details, and bank account information can be amended online through the GST portal.

What is the validity of GST registration?

GST registration is valid until it is surrendered, cancelled, or suspended.

Is there any fee for GST registration?

No, there is no fee for GST registration when done through the official government portal.

Can I have multiple GST registrations?

Yes, a business with operations in multiple states must have separate GST registrations for each state.

How can I check the status of my GST registration?

You can check the status of your GST registration application on the GST portal using your ARN (Application Reference Number).

What happens if my GST registration application is rejected?

If your application is rejected, you will be notified of the reason. You can rectify the issues and reapply for registration.

NextWhatBusiness Research Desk represents the editorial research function at NextWhatBusiness.

Content published under the desk is based on independent research, operator-level observations, and analysis of small, medium, and franchise-led business models in India.

The focus is on practical decision-making — including capital requirements, operational effort, and risk factors — rather than promotional or brochure-driven information.

Some articles reflect editorial judgment based on observed patterns and may include opinionated analysis where appropriate.

Editorial oversight is provided by Rupak Chakrabarty, Editor, NextWhatBusiness.