Zelio E-Mobility, a relatively young but fast-moving player in India’s EV space, is gearing up for its boldest move yet. The Haryana-based startup has announced plans to set up a dedicated manufacturing facility for electric three-wheelers (e-3W) by April 2026. For a company that has so far been known mostly for its low-speed e-scooters, this expansion feels like a big leap — one that could completely change its game over the next two years.

Table of Contents

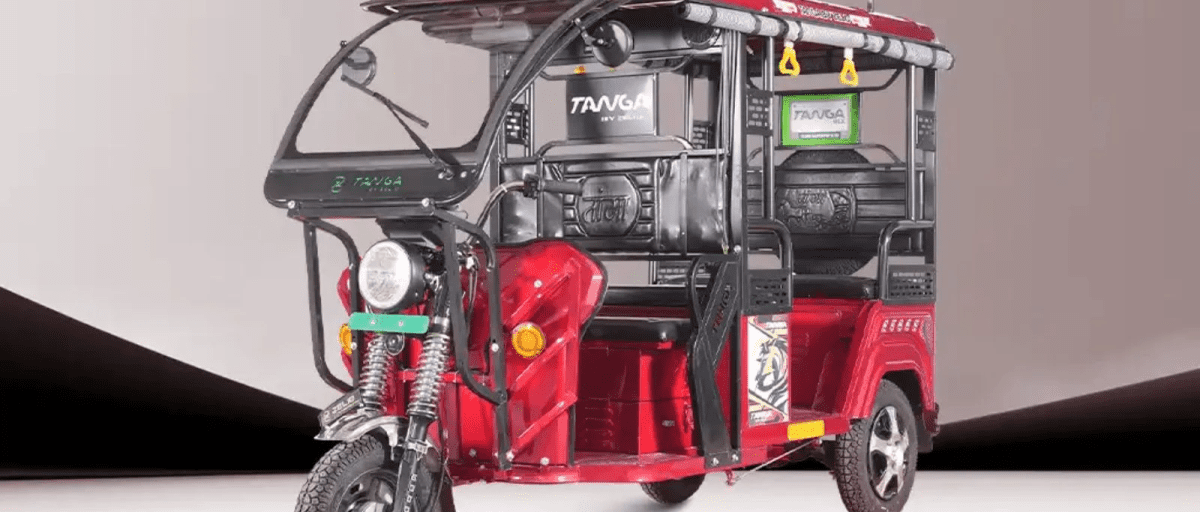

From Scooters to “Tangas”

If you’ve heard of Zelio before, it’s probably because of their electric two-wheelers — affordable, low-speed scooters that cater to students, elderly folks, and anyone needing short, zippy rides. The company’s existing plant in Hisar churns out around 72,000 units annually in single-shift operations, though it has been running at a little over 50% capacity as of March this year.

Now comes the three-wheeler chapter. Zelio is pushing its Tanga brand of e-rickshaws into the spotlight. And not just as a side gig — management expects three-wheelers to contribute a hefty 30–40% of the company’s revenue within the next two years. Considering how competitive the e-rickshaw market has become, that’s a serious bet.

“We don’t want to be seen only as a two-wheeler company,” CFO Shubham Garg remarked while speaking about the move. “This diversification reduces risk and gives us a stronger product mix.” His tone was pragmatic, but you could sense the underlying excitement, too.

Read: Best EV Business Ideas

Money Matters: The ₹20 Crore Plant

Setting up a brand-new plant is never cheap, and Zelio isn’t shying away from the numbers. The company has lined up about ₹20 crore for the new facility, while another ₹19–20 crore will be allocated toward R&D, working capital, and paying down some debt. It’s not massive by auto industry standards, but for a mid-tier EV startup, that’s still a solid investment.

For context, Zelio posted some rather impressive numbers in FY25:

- Revenue: ₹172 crore

- EBITDA: ₹21 crore

- Profit after Tax (PAT): ₹16 crore

- Net worth: ₹26.67 crore

And here’s what stands out: between FY23 and FY25, the company grew revenue at a whopping 83% CAGR, while profits shot up at an even higher 128% CAGR. Not bad at all for a brand most urban consumers may not even recognise yet.

The IPO buzz

Of course, big plans need big money, and Zelio is already knocking on the capital market’s door. The company has launched an SME IPO worth around ₹78 crore, approved by SEBI, with the subscription window running from Sept 30 to Oct 3, 2025.

The details:

- Fresh equity shares: 46.2 lakh

- Offer for sale: 11.4 lakh shares

- Price band: ₹129 – ₹136 per share

- Listing: BSE

- Book-running lead manager: Hem Securities Ltd.

Now, IPOs in the SME segment can be a bit unpredictable. But if Zelio manages to strike the right chord with retail investors, this could provide the financial muscle it needs for the 2026 expansion.

Why three-wheelers?

Some might ask — why leave the safer scooter market for three-wheelers? Well, for one, the e-rickshaw industry in India has exploded over the last decade. It’s become the backbone of short-distance commuting in tier-2 and tier-3 cities, and even metro suburbs. Low operating costs, demand for last-mile connectivity, and government EV incentives have all created a fertile ground.

For Zelio, this isn’t just diversification — it’s about seizing a share of an already booming market. If they play it right, e-3Ws could actually generate faster revenues than their scooters.

But it’s not without challenges. Margins are tight, competition is fierce, and supply chains (especially for batteries) can be messy. That said, Zelio seems confident it can carve out space by positioning Tanga as a reliable, cost-effective brand.

The Road Ahead

Looking further, the company has hinted at possible additional plants in southern and eastern India to reduce distribution and logistics costs. Though no formal announcements have been made, it wouldn’t be surprising if Zelio scales aggressively once the 2026 facility is up and running.

Industry watchers believe the next 18–24 months will be a defining period. If the three-wheeler project hits its milestones, Zelio could well transition from being “just another scooter maker” to a more well-rounded EV mobility player. If not, it risks spreading itself thin at a time when competition from larger brands is heating up.

The Bigger Picture

It’s also worth noting the timing. India’s EV policy landscape has been shifting in favour of electric three-wheelers. States like Delhi, Uttar Pradesh, and West Bengal are already seeing massive adoption, thanks to subsidy programs and demand from both fleet operators and independent drivers. In many ways, Zelio’s move feels less like a gamble and more like catching a wave just as it’s cresting.

Yet, there’s emotion behind the numbers, too. You can sense that Zelio’s founders — Niraj Arya, Deepak Arya, and Kunal Arya — are chasing something bigger than revenue charts. It’s about proving that a mid-sized startup from Hisar can play in the same sandbox as bigger EV giants. There’s a bit of underdog grit in the way the company talks about its future.

Final word

So, will Zelio’s ₹20-crore e-3W plant really change the company’s fortunes? Hard to say right now. But one thing’s for sure — they’re not just sitting back and playing safe. They’re hustling, they’re betting, and they’re trying to grab their slice of India’s electric mobility pie.

As the IPO subscription closes and 2026 draws closer, all eyes will be on whether this gamble pays off. For now, though, Zelio has at least managed to stir curiosity, and in today’s noisy EV market, that’s half the battle won.

Rupak Chakrabarty is the Editor at NextWhatBusiness and a business strategy analyst with over two decades of hands-on experience advising small and mid-sized businesses. His work focuses on entrepreneurship, franchise models, business planning, and market behaviour, with an emphasis on practical decision-making over theory. When not writing or consulting, he enjoys adventure sports, speed, and exploring stories behind businesses.